liberty tax advance denied

The IRS no longer provides tax preparers banks or lenders with a debt indicator which advises the lender in advance whether any part of your refund is earmarked for offset. Liberty Tax Loans Are Available 24 Hours a Day 7 Days a Week Year Round.

Liberty Tax Tax Refund Advance Review 2022 Finder Com

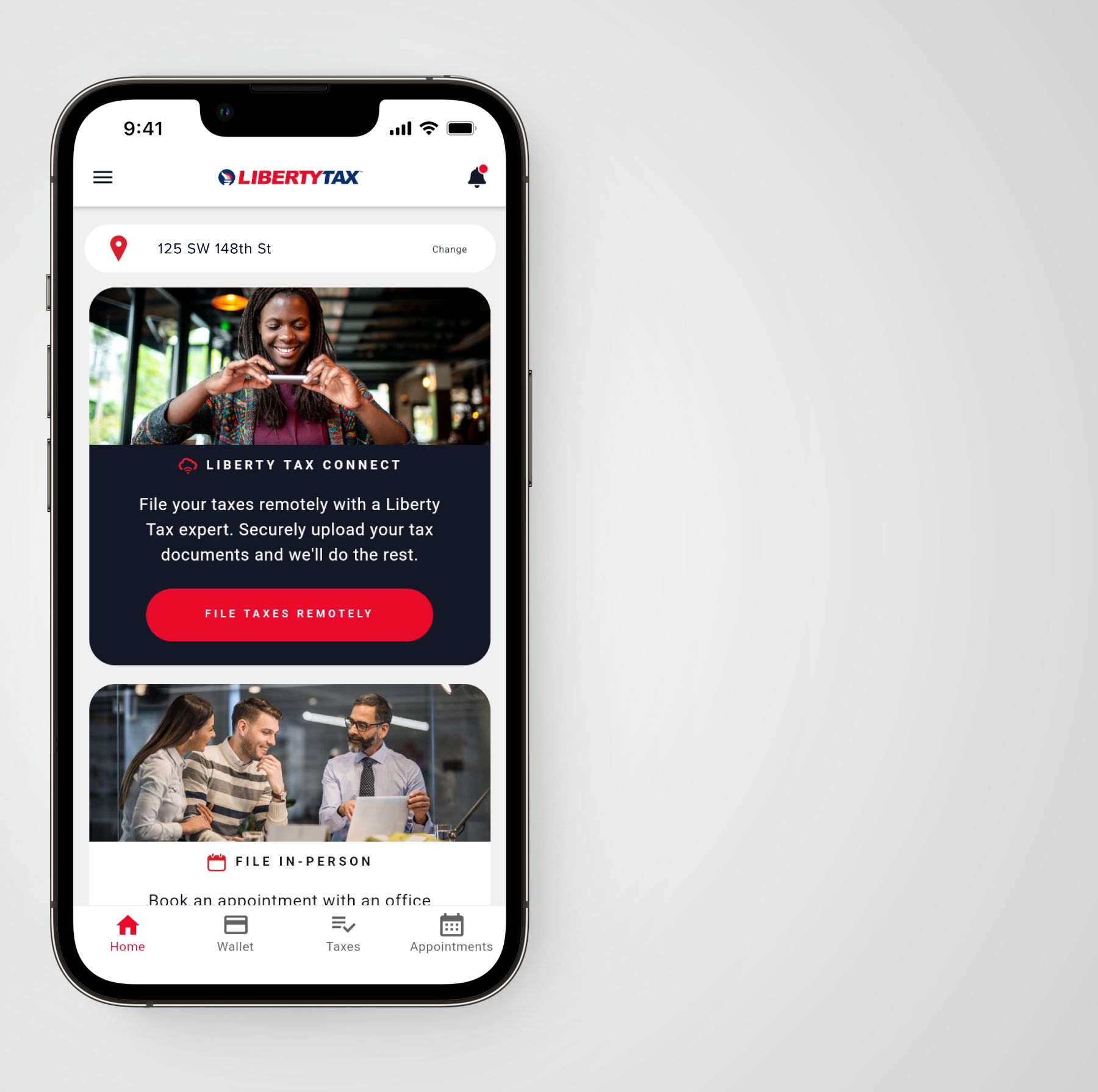

Liberty Tax Liberty Tax offers easy advance loans in the amount of 500 - 1300 for tax payers who qualify.

. Deadline to apply. Basic 4495 plus 3995 per state return. You have bad credit.

COMPARE convenience OTHER WAYS TO FILE If youd rather not file online set up an. I was able to work for them this last tax year. If youve been turned down for a tax refund-related loan it might have been for one of these reasons.

There are a couple of things that could be going on. Remember that an ral is a loan. You can apply for an advance of 250 500 750 to 1000.

The IRS started sending the third Economic Impact Payments to eligible individuals on March 12 2021. You have to repay. By webcpa staff june 22.

This plan is a good choice for single filers or married couples with no. Sign-in using your Liberty Tax Personal account to access systems secured by this service. APRs for cash advance loans range from 200 and 1386.

Your expected refund must be at least. If the loan application is denied you cant go elsewhere to try to get that loan HR Block told NBC News BETTER that about 75 percent of those who apply get the refund. Liberty Tax Advance Denied.

Remember that an RAL is a loan. In order to apply for a tax refund loan through Liberty Tax Loans you have to meet the minimum requirements. Liberty Tax gives you the help you want the tools you need and the experience you deserve.

Amount of the advance. Payments will be sent to eligible people for whom the IRS did not have information to send a payment but who recently filed a 2020 tax return. Liberty Tax Service has three levels of online tax filing and preparation.

Date is subject to change. Lenders Have Thousands To Lend And They are Ready To Accept Your Application h Step 1 Fill out the fast. The EIP3 was 1400 per taxpayer spouse if filing a joint return and each dependent.

Even better you can get the advance with 0 loan fees and 0 APR. Liberty tax advance reviews friday june 10 2022 edit. It just hit me right.

United States citizen or legal resident. You must be at least 18 years. Some states have laws limiting the Annual Percentage Rate APR that a lender can charge you.

Tax Refund Advance Loans Not Always Fast Cash Guarantee

What To Do When Your Mortgage Application Gets Denied Bankrate

When Can A Lender Refuse A Car Loan Bankrate

Liberty Tax Tax Refund Advance Review 2022 Finder Com

What You Should Know About Tax Refund Anticipation Loans

Liberty Tax Review Quick Option For Filing Your Taxes Online The Dough Roller

What To Do When Your Balance Transfer Is Denied Bankrate

Liberty Tax Sued By Dc Attorney General For Predatory Cash Advance Promotion Advocate Andy Newsbreak Original

7 Reasons You Might Have Been Turned Down For A Refund Anticipation Loan

Liberty Tax Online Reviews 2022 Supermoney

Tax Refund Advance Loan Up To 3500 In Minutes Jackson Hewitt

Liberty Tax 901 Auburn Way N Auburn Wa Tax Consultants Mapquest

Can I Get A Loan Against My Tax Refund Experian

Too Many Autistic Adults Are Denied Basic Rights In America Bloomberg

Got Denied For A Tax Refund Advance Loan Top 10 Alternatives

Unum Disability Claim And Benefit Denial Help

Tax Preparation File Taxes Income Tax Filing Liberty Tax Service